The CRYVIS Token (CRVX) is a multi-functional utility token powering the CRYVIS ecosystem.

The CRVX token (1B fixed supply, multi-chain) powers CRYVIS' ecosystem with real-world utility across 3,800+ European merchants, MiCA-compliant governance, and value capture through revenue-sharing buybacks, platform fee discounts, and voting rights.

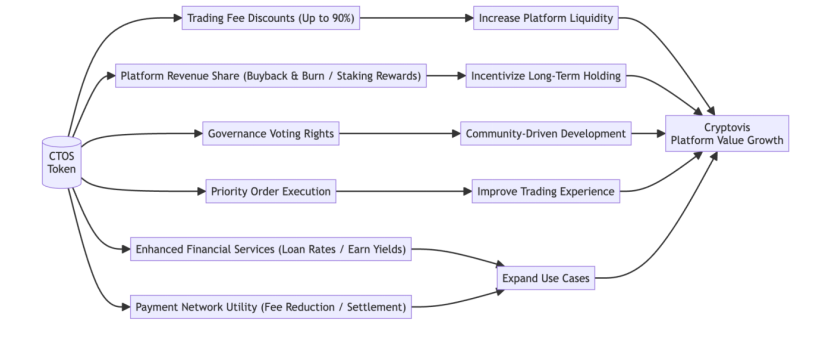

CRVX offers holders multiple benefits throughout the CRYVIS ecosystem:

● Trading fee discounts up to 90% based on holding/staking tier

● Priority execution during high volatility (reduces slippage up to 68%)

● Enhanced rewards for participating in platform activities

● Optimized cross-chain transaction costs

● Voting rights on key platform decisions (listings, fees, fund allocation)

● Tiered voting weight considering both holding amount and duration

● Early access to beta features and new products

● Priority participation in token sales on CRYVIS Launchpad

CRVX token holders unlock exclusive financial advantages including loan rate discounts (up to 56% lower APR), yield boosts (+2-4% APY), payment fee reductions (up to 75%), and premium institutional tools - delivering measurable value across CRYVIS' product suite.

● Discounted cross-border transfer fees

● Settlement medium within the European SEPA network

● Merchant acceptance program with 3,800+ European partners

● B2B settlement with 91% cost reduction compared to SWIFT

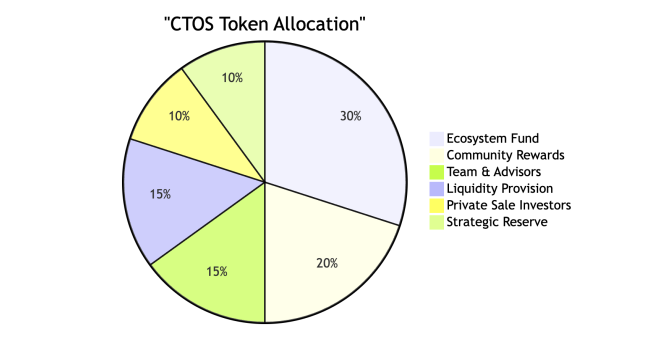

The total supply is fixed at 1 billion CRVX tokens, allocated as follows:

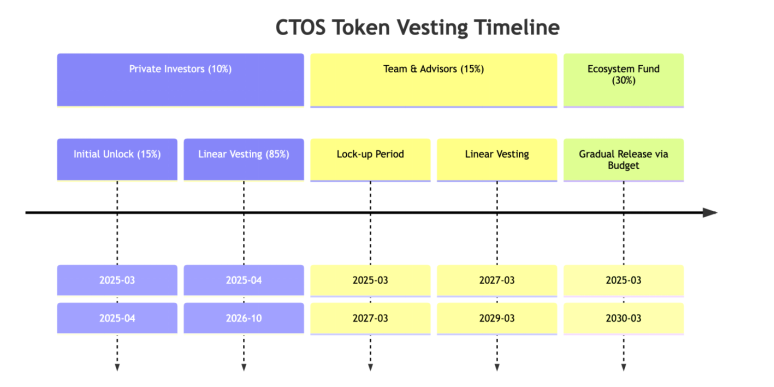

CRVX's 1B token allocation strategically distributes 30% to ecosystem growth, 20% to community incentives, 15% each to team (4-year vesting) and liquidity, with 10% reserved for investors and strategic needs - ensuring long-term platform development and market stability.

● Long-term alignment of team incentives (2-year cliff, 4-year total vesting)

● Protection against market pressure from early investors

● Sustainable release of tokens for community incentives

● Strategic flexibility through governed release mechanisms

CRVX's value is directly linked to CRYVIS's business performance through multiple mechanisms:

● Quarterly buybacks using 20% of platform revenue

● 50% of buybacks permanently burned, reducing circulating supply

● 50% distributed to stakers as additional rewards

CRVX staking offers tiered rewards from 4-12% APY, with higher tiers (requiring 5K-500K CRVX) unlocking progressive benefits including fee discounts (50-90%), governance privileges, and exclusive platform access - creating a scalable loyalty ecosystem.

● Proposal rights for holders meeting minimum thresholds

● Voting on key platform decisions like listings, fees, and development priorities

● Transparent on-chain or hybrid voting mechanisms

● Multi-sig execution of fund-related decisions

These mechanisms create a sustainable token economy that aligns user incentives with platform growth, rewards long-term holders, and enables community participation in platform development.

To build a borderless global financial network where everyone can participate in the digital economy equally, securely, and conveniently. We believe digital assets and blockchain technology hold the potential to fundamentally transform the global financial landscape, making it more open, transparent, and efficient.